Since the Evergrande Group triggered the 2021 real estate crisis in China, the financial health of mainland property firms has been under intense scrutiny. Country Garden Holdings Co. Ltd. (2007.HK), China’s largest real estate developer, is now at the epicenter of global financial discussions due to its dramatic downturn, with their stock plummeting by a staggering 56% within a month. But what led to its dilemma?

Back in 2017, Country Garden was incorporated into the Hang Seng Index. For six consecutive years, it held the title for mainland China’s top real estate sales. At its peak in 2018, the company’s stock price soared to HK$14, boasting a market capitalization of over HK$350 billion.

The market began to get wary of Country Garden’s debt risks around mid-July this year. By 17th July 2023, several of its bonds plunged by about 30%, fueled by rumors of potential payment defaults. These rumors became true in August. Country Garden defaulted on the interest of two company bonds totaling USD $22.5 million.

In the aftermath, the company announced the suspension of a batch of its domestic bonds. This, along with other unsettling news, heightened investor concerns over the company’s operating condition. By August’s Hang Seng Index quarterly review, Country Garden was removed from the index, losing its blue-chip status. From 31st July 2023 to 18th August 2023, its stock price plummeted from HK$1.74 to HK$0.76, marking a staggering 56% drop.

Country Garden’s vast scale is unrivaled in China. Its number of pre-sales and development projects is four times that of Evergrande Group. As of the end of 2022, Country Garden had construction projects amounting to RMB 884 billion spread across more than 200 cities in China, many of which are third or fourth-tier cities. To many, it is unimaginable that such a mammoth entity would fail to pay the bond interest.

Desperate Measures to Survive

Amidst the financial turmoil, Country Garden stated that in the face of extremely difficult situations in the industry, the company adopted four self-rescue measures: making every effort to ensure the safety of the company’s cash flow, accelerating sales receivables and accounts receivable collection, actively expanding financing, and striving to revitalize idle assets. The company also announced the sale of its equity in the Guangzhou Asian Games City project to China Overseas Land & Investment for approximately RMB 1.29 billion.

Are China’s Banking Sector and Hong Kong Market Safe?

But the pressing question remains: Can Country Garden stave off becoming another “Evergrande 2.0”? Despite different leverage levels, its escape from the current impasse might depend on government intervention.

Country Garden’s predicament points to a broader concern. China’s real estate sector comprises a hefty 6.1% of its GDP. And if we weave in the related sectors, that’s a colossal 20%-25%. Any significant shakeup in the property market inevitably strains China’s economic growth.

Investors are now sitting on a ticking time bomb, with banks having loaned vast sums to real estate developers. As these developers default, it could send a shockwave through the banking sector.

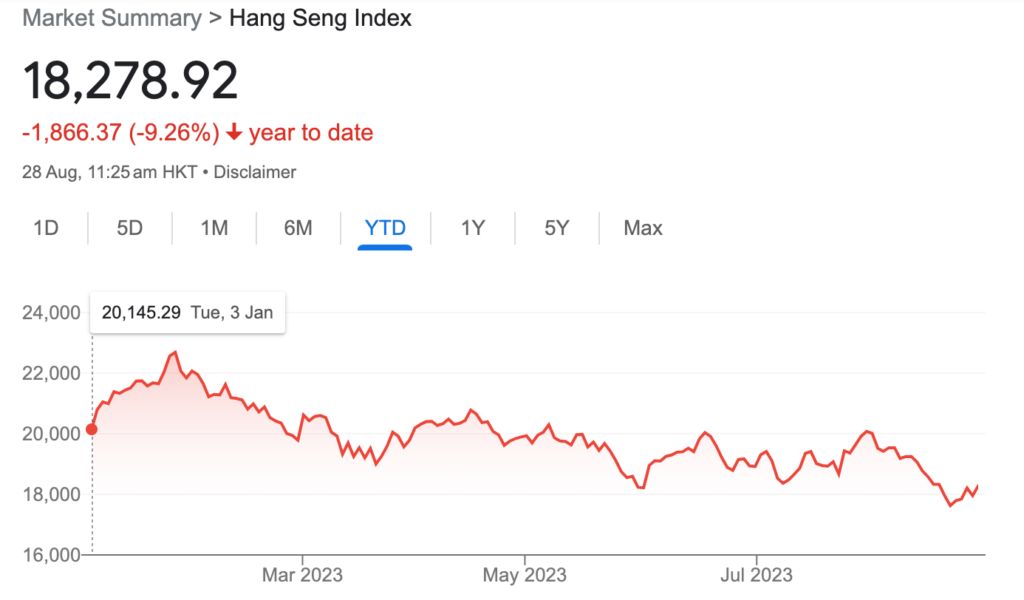

Today, financial stocks in both China and Hong Kong were not spared, experiencing an across-the-board decline. The Hong Kong stock market has taken a blow with mainland China yet to find an effective solution to the domestic real estate debt dilemma. Also, as the Chinese yuan weakens, it inevitably affects the prices of assets denominated in yuan. From July to August, the Hang Seng Index plummeted from 20,000 points to below 18,000, and there’s no sign of a rebound shortly.

For investors, patience might be the key. As we approach October, it will be essential to see the impact of the housing market’s crisis on banks’ profitability when they announce their Q3 results. Then we will have a clearer understanding of the market and be better equipped to predict its future direction.