Hong Kong’s recent decision to lower the stamp duty on stock transactions has stirred the financial waters. This decision, announced by Chief Executive Lee Ka-chiu, is a strategic move aimed at bolstering the competitiveness of the Hong Kong stock market. But how significant is this move? To what extent can this reduction influence the market dynamics?

Understanding the Stamp Duty Reduction

Stamp duty, a tax levied on stock transactions, has long been discussed among investors and policymakers. In Hong Kong, this duty was previously set at 0.13% for both buyers and sellers, a rate considered high compared to some other major stock markets. The reduction to 0.10% represents a return to the rate prior to August 2021.

The move to reduce stamp duty in Hong Kong followed an unexpected halving of the tax in mainland China in August 2022, which put pressure on Hong Kong to adjust its rates. The mainland’s decision positively impacted its stock market, prompting calls for Hong Kong to follow this approach. However, the different economic contexts and market structures of Hong Kong and mainland China mean that the effects of similar policies can vary.

When we look at stamp duty rates globally, the picture varies significantly. Singapore charges a 0.2% duty on buyers only. The U.K.’s stamp duty is 0.5% for buyers, with sellers exempt. In stark contrast, markets like the USA, Japan, and Australia do not impose any stamp duty on stock transactions. Hong Kong’s recent reduction is a testament to its commitment to staying competitive amidst a constantly changing global landscape.

Market Response to the Policy Change

The immediate response of the Hong Kong stock market to the policy announcement was robust. On 15 November, when the tax cut was announced, the Hang Seng Index rose by 3.92%, and the Hang Seng Tech Index saw an increase of 4.41%. However, this optimism was short-lived. Just a few days after officially implementing the reduced stamp duty on 17 November, all these gains had vanished. This fluctuation underscores the complexity of stock market dynamics and the many factors influencing it beyond just the transaction costs.

Though welcomed by investors, particularly those engaged in high-frequency trading, the reduction in stamp duty has a limited impact when considering the broader scope of market forces. If we compare the transaction costs for a HK$100,000 investment before and after, the reduction shows a modest decrease of HK$30 – a change that might not be significant enough to sway investor behavior on a large scale.

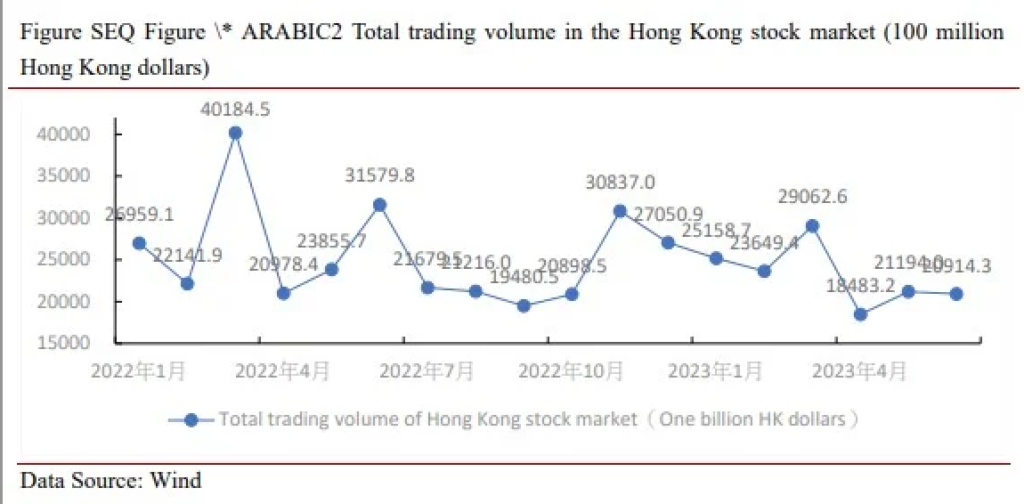

Moreover, the overall market performance and investor sentiment are not solely dependent on transaction costs. Factors such as economic indicators, global market trends, regulatory environments, and individual company performances play a substantial role in shaping investment decisions. The stamp duty reduction, while a step towards more favorable trading conditions, is not a silver bullet that can single-handedly reverse market trends or dramatically boost trading volumes.

A Step in the Right Direction, But Not a Panacea?

In conclusion, reducing stamp duty in Hong Kong is a positive development for the stock market, particularly for frequent traders. However, given the factors influencing investor behavior and market performance, its impact is limited.

In addition, Hong Kong’s decision to lower stamp duty must also be viewed in the context of its fiscal policy. With a high budget deficit, a significant reduction in stamp duty could exacerbate the fiscal imbalance.

The journey to revitalize Hong Kong’s stock market continues. This policy change is a step towards enhancing Hong Kong’s competitiveness in the global financial arena, but it should be seen as part of a broader strategy that includes other measures to attract investment and bolster market confidence.