The COVID-19 pandemic severely hit the Macau casino industry in the past three years, causing a more than 70% drop in stock prices for Macau casino operator Sands China (0880.HK) and similar drops to other major operators. However, easing pandemic restrictions in 2023 has brought hope to the industry and the investment sector.

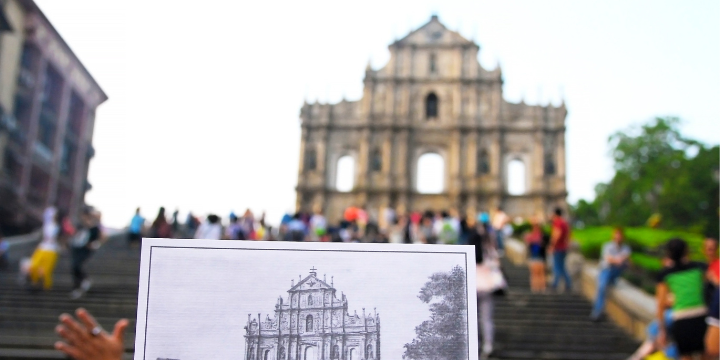

Post-pandemic Tourism Boosts Macau’s Casino Revenue

In January 2023, Macau’s gaming revenue increased 83% year-on-year, reaching the highest monthly revenue level in three years and recovering around 50% of pre-pandemic levels. According to a study by HSBC, daily visitors to Macau range from 47,000 to 50,000 after the Lunar New Year, with an increase in tour groups. Short-term momentum is expected to remain, with gaming revenue projected to be maintained between MOP 9.5 billion and MOP 10.5 billion in February, equivalent to around 37% to 41% of the revenue generated in February 2019.

As the tourism industry recovers, the hotel room supply in Macau has already reached approximately 80% of its maximum. However, a labor shortage, particularly in room services, has resulted in about 2,000 to 3,000 rooms being left vacant. The Macau government and industry are currently working to address the labor shortage, but there has been no significant impact on the operation of casino operators.

Possible Implementation of New Taxes on Casino Intermediaries Raises Concerns

While an industry-wide recovery is yet to come, a new challenge may occur. According to industry sources, during a recent meeting between the Macau government and casino operators, it was mentioned that casino junkets must pay a 5% tax on the 1.25% commission on rolling chip turnover, as stipulated in the Legal Framework for Operating Games of Chance in Casinos. The tax will be paid monthly, and the casino companies must pay it to the Macau Financial Services Bureau within the first 10 days of the following month. Although this regulation has been in the existing gambling law, the previous Chief Executives have all waived this tax.

The news of the intermediary tax had dragged down the stock prices of major Macau casino operators, including Melco International Development (0200.HK), Wynn Macau (1128.HK), Galaxy Entertainment Group (0027.HK), Sands China (1928.HK), and MGM China (2282.HK), with a drop of 1-4% on the same day when the news announced.

Experts Optimistic About Long-Term Investment Prospects

Despite the challenges, it is expected that as the Mainland reopens, the Macau entertainment industry will gradually return to pre-pandemic levels, and Macau casino stocks will perform well in 2023.

The Centre for Macau Studies and the Department of Economics at the University of Macau predict that the Macau economy will grow by 20.5% this year, with the most optimistic estimate reaching 44.1%. The growth is brought by the reopening after the pandemic, a low base effect from last year, and an expected more significant recovery in the second half of the year.

In the most optimistic scenario, the number of visitors in the third and fourth quarters will reach 70% and 80% of 2019 levels, respectively. Therefore, Macau casino stocks are still regarded as a good investment in the medium to long term.