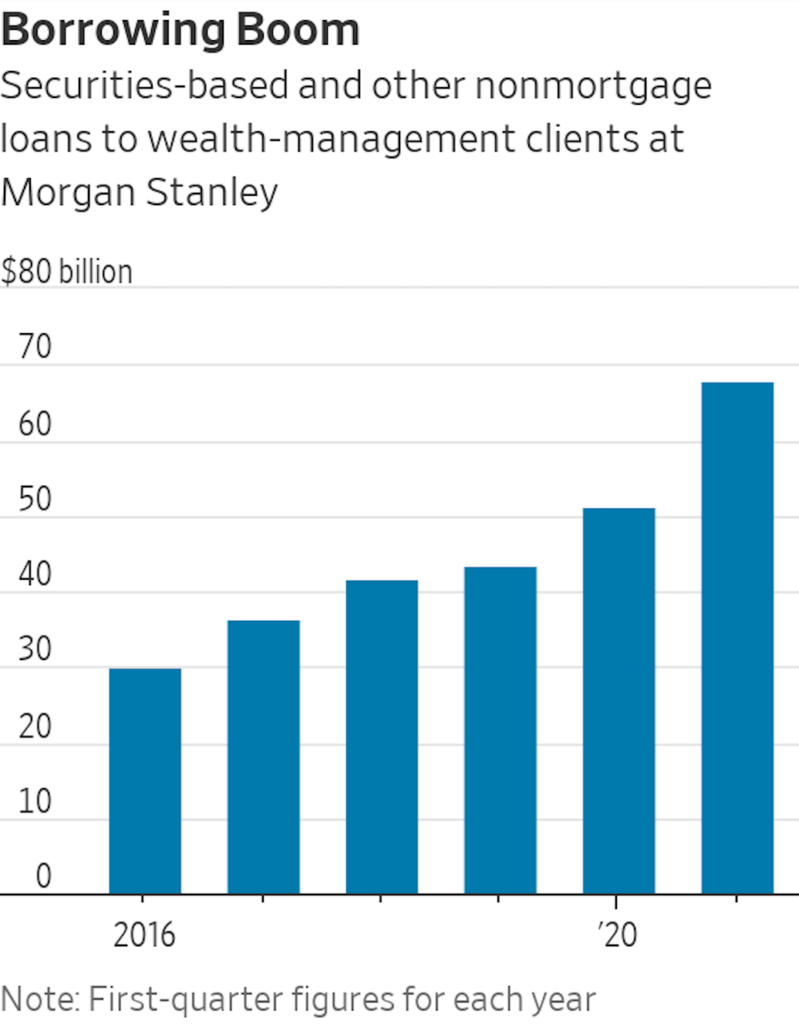

In recent years, wealthy investors have borrowed money more than ever before. Elon Musk and many billionaires are well known for using stock shares as collateral to borrow cash. This financing technique helps them increase their liquidity at ease and gain massive tax benefits at the same time. In 2021, Morgan Stanley wealth-management clients had US$68.1 billion worth of securities-based loans outstanding, which increased by more than a double compared to five years earlier.

Stock collateralization has become a personal finance trick for high net worth individuals (HNWIs), and many believe “the more you borrow, the richer you will be.” Meanwhile, banks are taking a more progressive approach in offering low-interest stock collateral loans to hedge against the market’s downside risk.

What are the benefits for HNWIs to pledge shares of a publicly-traded company to secure the loan? Here are some tips on getting the most out of your stock shares.

How to Borrow Again Your Stock Portfolio?

Borrowing money against a stock portfolio is nothing new for wealthy investors. A bank or financial institution offers a credit facility allowing investors to use their stock shares as collateral to obtain a loan. The loan size is usually about 60-70% of collateral shares’ market value.

Banks offer such loan products in diverse ways while there may be a wide variety of collateral assets accepted, such as stocks, funds, bonds, cash and time deposits. Therefore, an asset collateral loan product may sometimes be called “shares overdraft facility”, “stock loan quasi-mortgage”, “portfolio loan”, etc. But in this report, we will be focusing on using stock shares as the collateral.

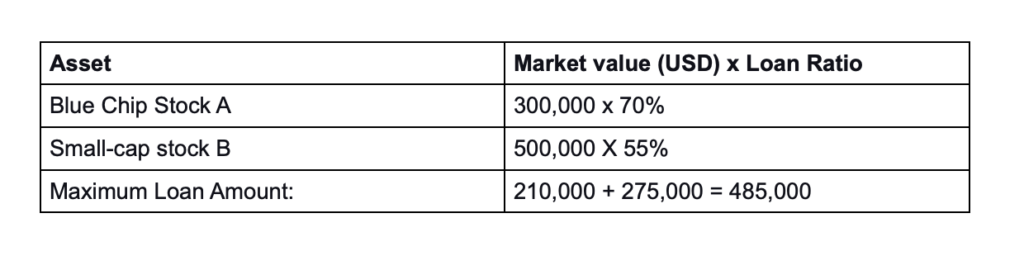

The loan size of a stock collateral loan largely depends on the quality of the collateral stocks. Banks usually have a list of collateral securities they accept, and borrowers can often enjoy a debt to asset ratio with blue-chip stocks than with small-cap stock shares.

Example:

Examples of How Billionaires Borrow Against their Shares

A stock collateral loan is a very convenient product for individuals and business owners to monetize the value of their stake quickly without selling any of their assets. It is efficient for entrepreneurs to finance their business operations.

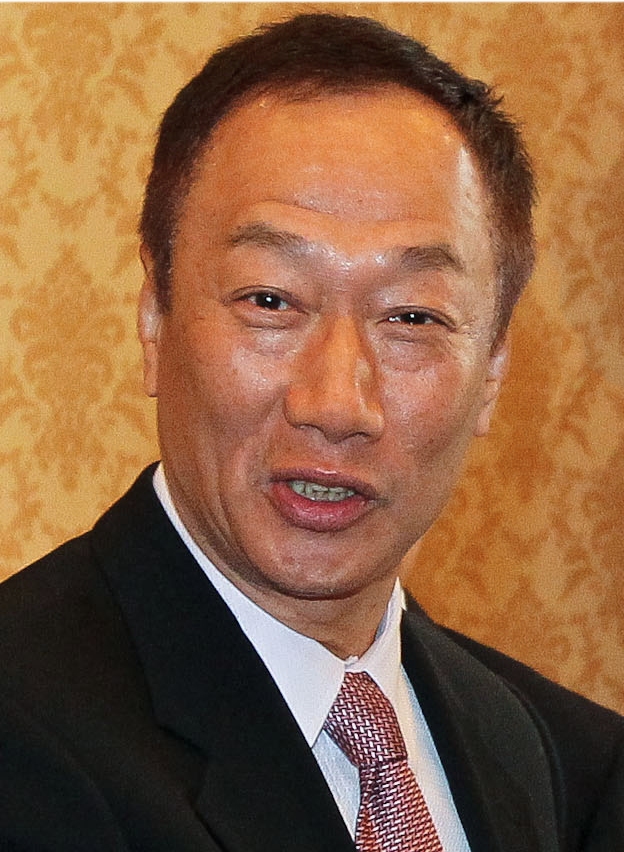

Terry Guo, the Founder of Hon Hai Precision

Terry Guo Taiming, Taiwan’s richest person and the founder of Hon Hai Precision, consistently uses stock collateral loans for business financing. For instance, in February 2020, he pledged more than 400 million shares of the company as collateral for a loan of about NT$24 billion (US$800 million). This financing strategy enabled him to acquire Sharp, a Japanese giant electronic products manufacturer, in 2016.

Elon Musk, the Co-Founder of Tesla

Before promising to sell 10% of his Tesla shares in 2021, the co-founder and CEO of Tesla, Elon Musk, was more famous for pledging his shares for lines of credit to cash out money from his pocket. Before that, he had already pledged 92,331,125 million of his Tesla shares as collateral to several banks to borrow cash. He could avoid paying billions of capital gains taxes on selling stocks by doing so.

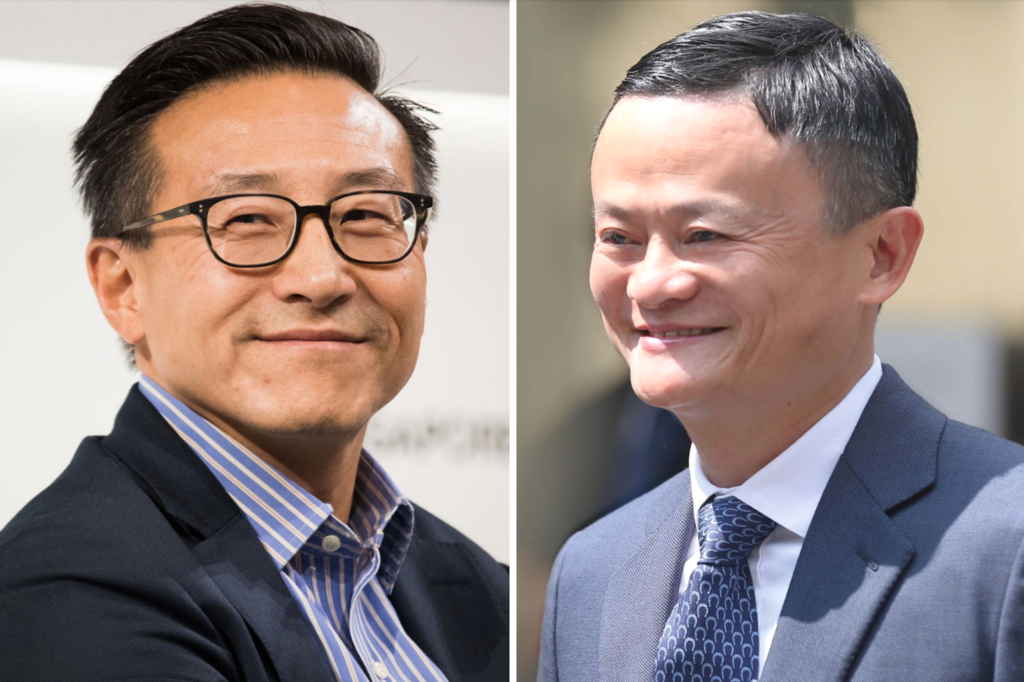

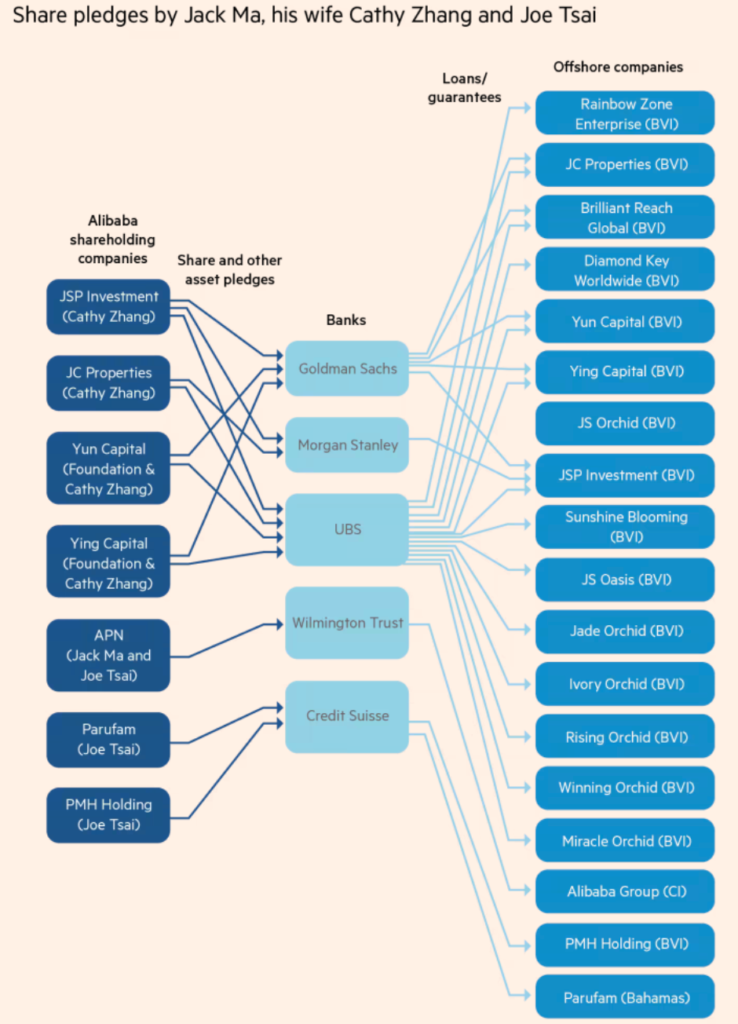

Alibaba co-founders Jack Ma and Cai Chongxin have repeatedly pledged considerable quantities of their Alibaba shares since 2014 in exchange for huge loans from investment banks such as UBS, Credit Suisse, Goldman Sachs and others. Their shares are reportedly transformed into substantial personal wealth through stock pledged loans.

▲ Jack Ma and Joe Tsai reportedly used stock collateral loans to cash out money. Source: Financial Times

What are the Benefits of Securities-based Loans?

You don’t have to be as rich as Elon Musk to enjoy the benefits of stock collateralization. As long as you are holding sizable shares of a listed company, you are entitled to enjoy the same blessings.

No Limitation on Loan Purpose

The loan purpose of a stock margin loan is limited to the stock investment only, while a mortgage loan can only be used to buy a property. The stock collateral loan, however, can be used for any purpose. Like a personal loan, the banks usually do not request the borrowers to submit any proof of loan purpose when approving the loan. You can use the loan to invest, buy a home, pay off existing debts, and settle the cost of a medical emergency, or use it for travelling and entertainment.

Enjoy Tax Benefits in Some Countries

In the U.S., the federal capital gain tax can be as high as 37%. On top of that, citizens may also be taxed by their state. For example, California’s maximum capital gain tax rate is 13.3%, while in New York state, it is 8.82%. The capital gains tax calculation is based on the difference between the price of the stock when it is sold and the original purchase price. With a higher amount of investment and profits, the more a U.S. citizen will be taxed.

In contrast, the loan interest expense is much less than the capital gain tax. For many wealthy U.S. citizens such as Elon Musk and Larry Ellison, borrowing against shares is a legal tax avoidance mechanism to save a tremendous amount of taxes. According to research, 32 billionaires on the Forbes 400 have pledged stock of NYSE or Nasdaq-listed companies in exchange for lines of credit, in which tax avoidance is believed to be one of their foremost considerations.

Cash-out and Increase Liquidity in a Simple Way

Compared with property mortgages or other types of collateral loans, the stock loan model is an easy and fast approval loan with high flexibility. Holding the eligible asset is almost the sole requirement for borrowing this type of loan. You won’t need to have a perfect credit score or submit proof of income, and the loan can get approved within a few days.

Borrow with a Low-Interest Rate

Interest rates play a vital role in borrowing any loan. On some occasions, the interest rates of unsecured and secured loans could have a vast difference. As a secured borrowing, stock collateral loans tend to have lower interest rates close to the prime interest rate, which is more attractive than most other loan offerings.

Align with Your Long-Term Investment Strategy

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years,” said Warren Buffett. Successful HNWI investors usually don’t speculate on the market. They tend to buy a good asset and keep it for a long time. A stock collateral loan allows the rich to increase their liquidity without selling the blue-chip stocks or growth stocks.

For founders and major shareholders of listed companies, this also helps them avoid equity dilution and remain in control of the company. They can hence monetize their shares without losing control of the companies. As a result, the rich are not forfeiting the wealth growth opportunities already held in your hand.

What are the Drawbacks of Borrowing Against Shares?

All investments involve risk, and every loan does. Borrowing money using your investment assets is certainly not a risk-free financing tool.

Borrowers May be Forced to Sell the Stocks in Bear Market

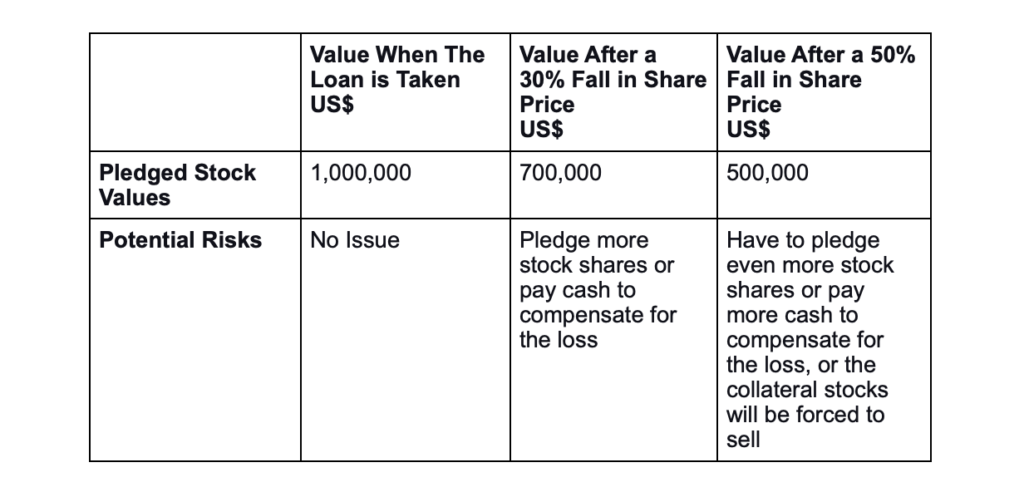

Like a margin loan, forced liquidation of shares may occur to stock collateral loan borrowers in extreme market conditions. If the stock price drops significantly and becomes lower than the minimum threshold set in the loan terms, borrowers will be driven into a dilemma: either pledge additional securities or pay cash to uphold the line of credit, or the bank has the right to sell part or all of your pledged shares to recover the loss of stock value.

For instance, if Hon Hoi’s stock price drops sharply, the company founder Terry Gou who is borrowing against his shares, may have to pledge more collateral shares or repay part of his loans to secure his shareholdings.

If a prolonged bear market emerges and the stock prices continue to fall, investors have to consistently pledge additional shares or cash to compensate for the difference in collateral value, which could be a bottomless trap hole.

|

|

|