Thailand has taken a decisive stand against naked short selling. This measure, aimed at stabilizing the Thai stock market, comes amid growing concerns over the role of foreign investors in short-selling activities.

In essence, short selling is a bet against a stock or security, where investors sell stocks they do not own, anticipating a price decline. Once the price falls, they repurchase the stock at a lower cost, pocketing the difference. On the other hand, Naked short selling is a more aggressive tactic where investors sell stocks they haven’t borrowed or don’t own. It’s often viewed as a riskier and more speculative practice.

Thailand’s Proactive Response to Market Speculation

Pakorn Peetathawatchai, the chairman of the Stock Exchange of Thailand (SET), points out that a substantial portion of short-selling transactions in Thailand is conducted by foreign investors, primarily involving large-cap stocks in the SET50 index. The figures are telling: In the first two weeks of November alone, foreign investors sold off Thai stocks worth 7 billion baht, bringing the year’s net sales to a staggering 180 billion baht. To put this into perspective, the net buying position in 2022 was 202 billion baht. This influx of foreign short-selling has been critical in the Thai market’s recent volatility.

The Thai SEC’s measures, as spearheaded by Pakorn, are not about imposing a blanket ban on short selling but rather targeting the more speculative and risk-laden practice of naked short selling, which aims to maintain market integrity without stifling traditional trading practices.

Kittiratt Na-Ranong, a former deputy prime minister and finance minister, now an advisor to the Thai prime minister, emphasized the importance of these measures. He noted that concerns over short selling could affect market confidence, and tackling naked short selling is part of boosting investor faith.

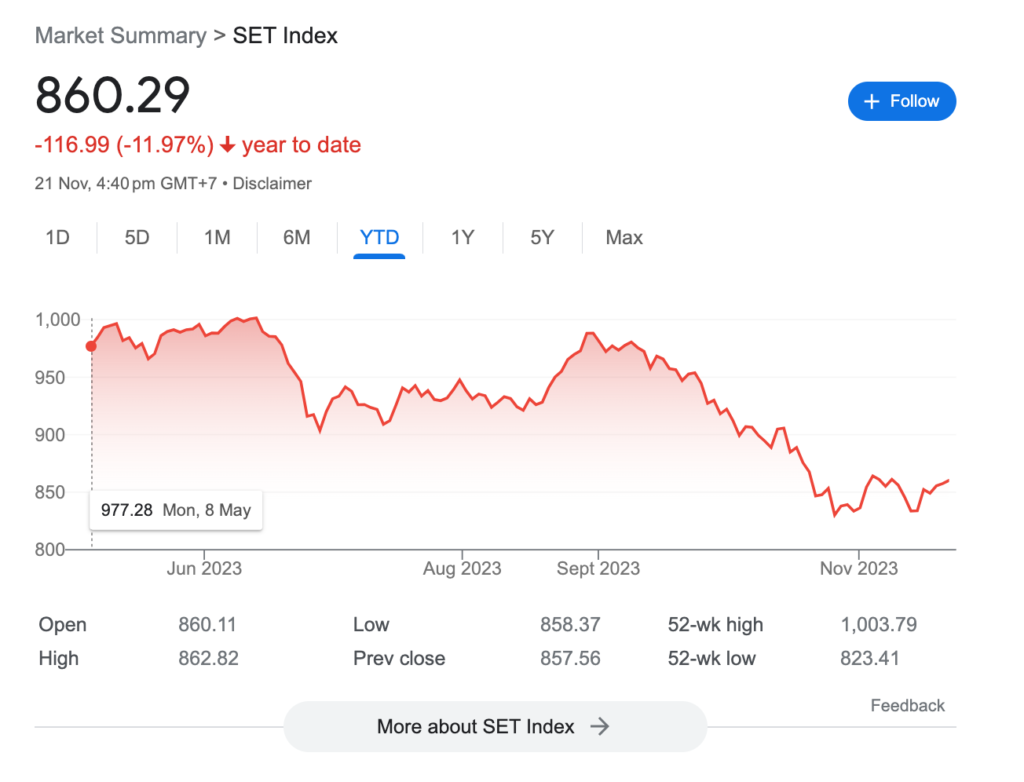

But is this enough to steer the SET index, which has plummeted more than 10% since the year’s start, back to a bullish course?

South Korea’s Experience

On 5 November, the South Korean securities regulatory authority issued a ban, prohibiting investors from shorting stocks in the KOSPI and KOSDAQ indices until the end of June 2024, but existing bearish positions were not affected.

Following the announcement of the ban, the composite index of South Korea saw a significant increase of 5.66% the very next day, while the KOSDAQ index recorded an even higher single-day gain of 7.34%, marking the highest growth in three years. However, the following days saw a decline in both indices, with the KOSDAQ index falling for five consecutive days, ultimately negating the gains made earlier.

Hong Kong’s approach is more about ensuring accountability and transparency in short-selling activities. The city’s Securities and Futures Ordinance mandates that short sellers must borrow the stocks or ensure they can be borrowed before initiating the sale. This system aims to maintain market order and prevent undue speculation.

Assessing the Impact of Regulatory Measures

In summary, while Thailand’s actions to curb naked short selling, especially concerning foreign investor activities, demonstrate a strategic initiative toward market stabilization, the effectiveness of such measures in truly safeguarding the stock market remains uncertain. Drawing from South Korea’s example, where a comprehensive short-selling ban did not yield sustained market improvement, it becomes evident that the impact of regulatory strategies on market performance is complex and multifaceted. This underscores the challenge for emerging markets in navigating the intricacies of globalized finance, where clear-cut solutions are often elusive and the outcomes of regulatory interventions are difficult to predict with certainty.