ESG (Environmental, Social Responsibility and Governance) investing has emerged as the hottest investment theme across the Asian markets. ESG indexes and rating models are more often used in stock analysis. Numerous asset management companies have launched funds utilizing sustainable development and the ESG concept to attract investors who treat social and environmental impacts as major concerns in making investment decisions.

What is ESG Investing?

The concept of ESG investing was first proposed by the former UN Secretary-General Kofi Annan as early as 2004. The United Nations later published a report, “Who Care Wins”, explaining how ESG impacts companies’ long-term financial performance and advocating companies to adopt ESG as their goals and metrics.

The three pillars of ESG include:

- Environmental protection (Environmental): climate risk, energy use, pollution treatment, natural resources, etc.

- Social: labour issues, information security, product liability, etc.

- Corporate Governance: Quality and effectiveness of the board of directors, corporate management, risk management, etc.

For retail investors, ESG investment means that they consider ESG when conducting investment activities to understand the opportunities and risks of investment. While the company’s ESG performance is often difficult to display in the financial statement, professional institutions in the market create ESG scores and ratings, which help investors make decisions.

The scale of ESG Investing

According to Reuters, as of November 30, 2021, ESG investment has reached $649 billion, up more than 127% from 2019.

Bloomberg predicts that by 2025, the total amount of ESG-related assets will exceed US$53 trillion, and there is room for growth in both market size and market share.

In addition, Hang Seng Investment Management Co., Ltd. also pointed out that the United States is currently the most significant driver of

8%). The Chinese government has also begun to attach importance to ESG development, encouraging companies to concern more on environmental and social responsibilities and setting up ESG indicators for domestic investors.

ESG Scores and Ratings

Many rating agencies around the world have launched their own ESG scores. As ESG rating agencies rely on data voluntarily disclosed by companies, the ratings that companies receive may not be consistent. There are more than 600 ESG scoring standards in the world. Here are some examples:

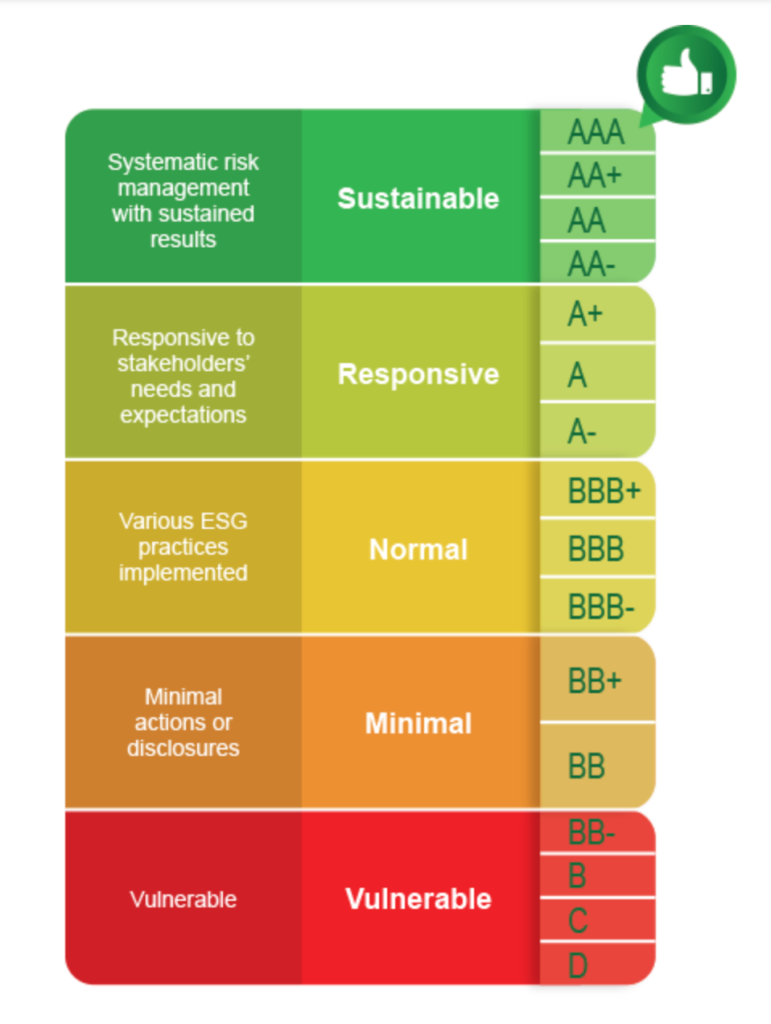

- Hang Seng Index ESG Rating: There are a total of 16 grades from AAA to D. Approximately 500 Hong Kong-listed companies and over 1,400 A-shares companies are classified into five gradings: sustainable, responsive, normal, minimal and vulnerable.

- MSCI ESG Rating: Equity and fixed income securities, loans, mutual funds, ETFs and countries are rated by MSCI. The rating is divided into grades ranging from leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC).

- S&P Global ESG Scores: The total score is 100 points. The better the company’s ESG performance, the higher the score. 10,000+ companies are being rated.

Why Are the Benefits for Individual Investors to Participate in ESG Investing?

Investing in companies that value ESG metrics can be seen as supporting their contributions to issues such as climate change, gender equality, racial equality and labour benefits. As companies seek to fulfil shareholders’ expectations, they may change their operating policies to deliver more positive impacts on the environment and society.

In addition, pursuing social goals over financial benefits can also help improve companies’ public images and reduce negative news and risks related to environmental protection and social responsibility.

In fact, companies that comply with ESG standards often outperform the market. S&P Global analyzed the performance of 26 ESG exchange-traded funds. In the 12 months after the WHO declared the COVID-19 pandemic, 19 ESG ETFs rocketed as high as 27.3% to 55%, outperforming the S&P 500 index, which rose 27.1% in the same period.