The electric vehicle (EV) market is booming globally, and Delta Electronics Thailand is riding the wave. Over the past year, the company’s share price skyrocketed over 180%, reaching a market cap of 1.2 trillion baht and surpassing the value of its parent company and the world’s most valuable airport operator, Airports of Thailand. So, what’s behind this extraordinary growth?

Record-Breaking Revenues Driven by Global Supply Chain Reorganization

In its 2022 annual report, Delta Electronics revealed record-breaking revenues of 119.89 billion baht, an increase of approximately 40% year-on-year. Earnings per share skyrocketed by over 129% to 12.30 baht. The power electronics segment revenue, including EV-related and other power supply sales, grew to 77% in 2023, up 4.2 percentage points from 2021.

In February 2022, the Thai government announced a series of incentives for the EV market, such as lowering import tariffs by up to 40%, reducing consumption tax on passenger cars from 8% to 2%, and providing cash subsidies of 70,000-150,000 baht per vehicle. The government also established a committee in 2020 to prepare the local automotive supply chain for zero-emission vehicle production.

While many believe the Thai government’s incentives have spurred Delta Electronics’ soaring share price, the global supply chain reorganization is the real catalyst. Though Thailand’s EV market is relatively small, car manufacturers like BYD, Great Wall Motors, and Tesla have already set up factories in the country. Delta Electronics, a pioneer in EV and hybrid vehicle component supply, has been expanding its EV business, providing power converters and aiming to supply complete power drive systems for controlling EV speed.

Shifting Market Focus

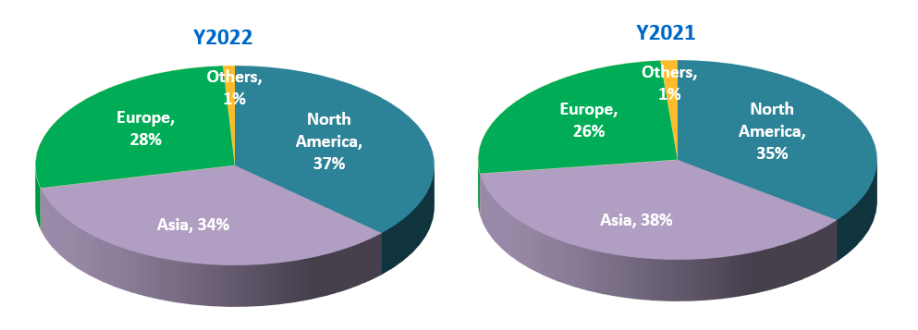

According to LMC Automotive, global EV sales reached 7.8 million units in 2022, a 68% year-on-year increase. Motor Intelligence reported a 65% annual growth rate in US EV sales, while traditional car sales declined for the first time in over a decade. Under this trend, Delta Electronics’ primary market has shifted from Asia to North America and Europe, where the EV market is booming.

In March 2023, the company announced a plan to establish a subsidiary in Hungary to meet the EV and servo systems demand in Europe. It is also expanding its capacity in Thailand and Slovakia to meet the growing demand for electric vehicle production.

Is Delta Electronics Overpriced?

However, analysts remain cautious about the company’s soaring stock price, questioning whether the EV market hype or other factors drive it. Limited tradable shares and the scarcity of EV-related stocks in Thailand’s market may also contribute to Delta Electronics’ high valuation.

Financial analysis firm Seeking Alpha commented that Delta Electronics’ stock price premium might be due to its inclusion in the widely-watched SET50 index at the beginning of 2023 and the lack of pure EV brands in Thailand for investors to bet on.

The current price-to-earnings ratio of 78.53 has raised eyebrows among investors who question the stock’s value. Yingyong Chiaravutthi, Head of Investment at Thanachart Fund Eastspring, said, “Delta Electronics Thailand has no logic in having a higher market value than its parent company. We are very cautious about this stock.” In March, the Stock Exchange of Thailand (SET) issued a statement warning investors to exercise caution when trading Delta Electronics shares after the price surged for three consecutive days.

In conclusion, the rise of Delta Electronics Thailand as the most valuable listed company in the Thai stock market demonstrates the power of global supply chain restructuring and the potential of the EV industry. While the growth of demand and a lack of tech stocks in Thailand has contributed to the company’s growth, it’s crucial for investors to consider the company’s long-term viability and future challenges.