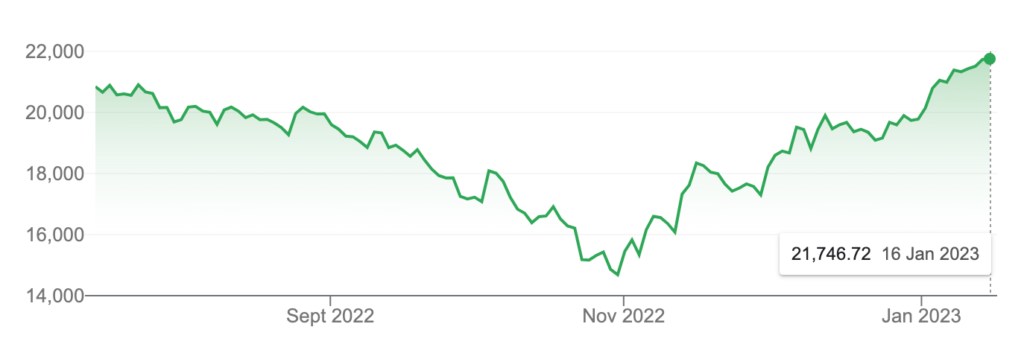

2022 was a bad year for the stock market. Whether it was in stocks, bonds, currency, or commodity sectors, it was too easy to lose money. However, Hong Kong stocks have started well in 2023, with the Hang Seng Index closing at 21,746 points on 13th January, a rise of about 8% in the first nine trading days. The Hang Seng Index has rebounded from the October low of 14,597 points, up nearly 6,900 points, a rebound of about 50%.

The reasons for this rebound in the Hang Seng Index are due to the 180-degree policy turnaround in mainland China, with dynamic zero-clearing policies suddenly being abandoned. Hong Kong followed quickly, lifting most of its epidemic prevention measures, including the controversial Vaccine Pass. Hong Kong investors and analysts expect reopening the Hong Kong-mainland border to stimulate the economy and investment market. So, which investment themes should Hong Kong stock investors pay attention to?

The insurance industry rebounds

As Hong Kong and mainland China resumed quarantine-free travel on 8th January, mainland residents are expected again to come to Hong Kong to purchase insurance policies, which is very important for Hong Kong’s insurance industry and insurance companies.

Since the social events that broke out in Hong Kong in June 2019 and the Covid-19 epidemic outbreak in January 2020, the number of mainlanders coming to Hong Kong has sharply decreased. In the third quarter of 2022, the number of new insurance policies in Hong Kong was less than 12 billion Hong Kong dollars, a decrease of nearly 70% from the historic high of almost 40 billion Hong Kong dollars.

Now, insurance sales in Hong Kong are expected to regain growth momentum and bring upward momentum to insurance stocks with the reopening of the Chinese border this quarter. Since the beginning of 2023, many insurance stocks have risen sharply, such as Ping An Insurance (2318) went up 15%; China Life (2628) increased by about 9%; and China Pacific Insurance (2601) surged by 20%.

But will the mainland’s new wave of coronavirus outbreak increase insurance claims? Since most insurance products only cover critical illnesses but not COVID infection risks, the impact is expected to be minimal.

Retail and tourism industries are expected to benefit.

Chinese analysts estimate that the number of COVID-19 infections will peak after the Chinese New Year, which is bound to affect this year’s tourism and consumption during the Chinese New Year. On the other hand, the number of recovered patients has gradually increased, paving the way for the recovery of the tourism and consumption market.

Since most quarantine measures have been lifted, many tourist attractions and shopping malls in Hong Kong have seen an increase in the number of shoppers, and it is estimated that more recovered patients will be able to travel to Hong Kong during the Chinese New Year holiday. As a result, the stocks that benefit from the border reopening have colossal room to surge.

Don’t be too ambitious.

Overall, the Hong Kong stock market rebounded in 2023 with positive outlooks for the insurance, retail, and tourism industries. The lifting of quarantine measures and the resumption of travel from mainland China have brought new opportunities for these sectors. However, given the current global economic situation, no one should expect the Hang Seng Index to climb above 30,000 points shortly.

In addition, many of the stocks that benefit from the border reopening have already recorded significant gains, and now may not be the best time to enter the market. Therefore, when investing in Hong Kong stocks during the rebound, remember to take profits at the right time. Investors should be cautious and not be too ambitious to avoid potential losses.