The older generation of Asians is prudent in financial management and even stubbornly believes that loans are evil. When buying a car or a house, many take out the savings they have worked hard to save for a lifetime very forthrightly. This financial attitude sounds very safe, but people may miss tons of opportunities to grow their wealth if they never borrow a loan in today’s society.

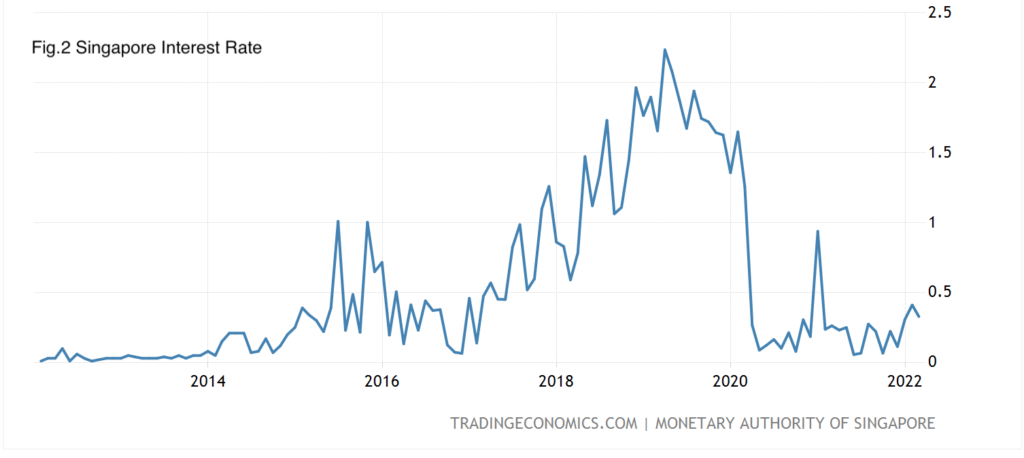

Nowadays, rich people constantly use cheap loans to cash out and invest smartly. In other words, these wealthy people turn others’ money into their cash flow. This strategy is particularly advantageous in Asian economies such as Hong Kong, Singapore and Taiwan, where the values of property and other assets have increased significantly over the past decade while low-interest loans are easy to borrow.

Rich People Use Loans to Make Themselves Even Richer

Let’s take buying a property in Hong Kong as an example. According to Demographia International Housing Affordability Report 2022, Hong Kong ranked the world’s least affordable property market for the twelfth consecutive year. It would take 23.2 years for a Hong Kong resident with an average income to buy a house even without spending money.

However, many Hong Kong homebuyers and property investors still use low-interest mortgage loans up to 90% of property value and 30 years tenor to purchase their houses. This strategy is proven victorious as the average housing price has increased by more than five times over the past 20 years.

Money is always in constant depreciation in the long run, and the more you borrow from the bank, the more profitable you are. If you borrowed a loan to buy a house 20 years ago, you would find that repaying the loan becomes easier and easier over time. It’s because the value of your loan is dwindling while your salary and the value of the property and other assets are constantly growing.

On the contrary, if a Hong Konger is working on an ordinary job and buying a car or a house only after saving enough money, he may never have enough money to reach his financial goal.

Investing with Leverage Using a Loan

Wealthy people understand how to borrow money from the bank to make their good life come earlier. They may not only borrow money when they need it. Instead, they may always find new investment opportunities and seek more liquidity for themselves through various channels.

The top principle is that they have to put the loan into a good investment, and the profits should exceed the interest expense. And learning how to borrow money reasonably and invest responsibly could be the best way to narrow the gap between ordinary people and the rich.

For instance, an investor has $100,000 in cash and buys 100 stocks at $100. If the stock price rises to $150, the value of the stock will become $150,000, and he will gain a 50% profit.

If he buys the stock using a margin loan, the leverage effect will allow him to enjoy a bigger profit. With a margin ratio of 50% and the same $100,000 cash, the investor can buy up to $200,000 in shares. When the stock price goes to $150, he will make a profit of 100% even after the loan has been repaid. (Of course, the investors have to pay some margin interest. )

More Benefits of Utilizing Loans

In Hong Kong, Singapore and many other markets, interest expenses from mortgage loans can be tax-deductible if certain conditions are met. And if you are investing in the name of a company, the loan interest you have paid can offset some profit tax. The tax advantages may make investors enjoy a powerful return exceeding the borrowing cost.

Moreover, borrowing money and repaying it on time can enhance your credit scores. Borrowers with higher credit scores can always have their loans approved more easily and enjoy low-interest rates. Therefore, instead of being hesitant about borrowing an investment loan, HWNIs should start investing with leverage as early as possible to maximize their gains. But of course, you must evaluate the risks properly and always remember to repay the loan on time to ensure financial health and sustainability.