As many countries are moving toward combating climate change by reducing greenhouse gas emissions, green investing has grown into a fast-growing market segment. An ETF tied to carbon futures debuted on Hong Kong’s stock exchange on 23rd March Wednesday, the first of its kind in the Asian financial hub. This article explains how carbon trading works and how HNWIs and retail investors can grasp this new investment trend.

What are Carbon Credits and the Carbon Trading System?

Carbon emission allowances are carbon emission rights issued by national or international governmental organizations under the emission “cap and trade” regulatory scheme. The European Union and countries such as the United States, Canada, New Zealand, Switzerland, Japan, South Korea, and China have created their national or regional emissions trading systems.

The European Union Emissions Trading System (EU ETS), launched in 2005, is the most established market globally. Under this system, the EU member states issued their carbon emission allowances or credits named European Union Allowances (EUA). Each allowance typically allows its holders (such as companies in the automotive, air travel and power industry) to emit one tonne of a pollutant. And the allowance units can also be auctioned or transferred to other emitters for free.

Some companies may generate less carbon than their allocated carbon allowances, and then they can trade the excess allowances on the carbon market. On the other hand, companies that produce more carbon emissions than allowed will need to buy extra permits to avoid heavy fines.

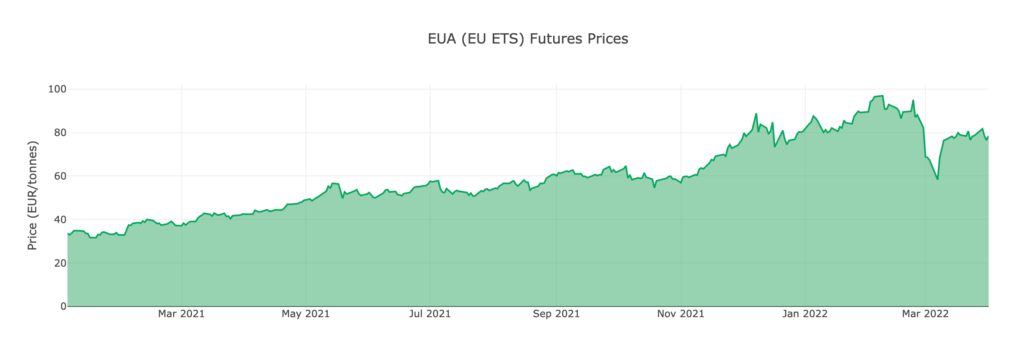

Between 2020 and 2021, the price of a tonne of carbon in the EU ETS has doubled. And analysts from Refinitiv said the value of traded global markets grew by 164% to a record $851 billion over the same period.

What is a Carbon Futures ETF?

A carbon futures contract is a commitment between buyers and sellers to buy or sell a predetermined amount of carbon emission allowances at a predetermined price on a specified date.

EU allowances futures contracts are traded on various exchanges such as European Energy Exchange (EEX) and Nasdaq Oslo. While industry operators use these futures contracts for hedging or locking in the cost of carbon emissions, investors may also use these futures contracts to bet on the rise and fall of the price of carbon emission allowances.

Before Hong Kong, several carbon futures ETFs had already been launched in the exchanges in North America. This kind of ETF tracks the performance of an index consisting of carbon futures contracts, which means the fund managers invest in the corresponding carbon futures contracts according to the proportion of carbon futures contracts in the corresponding index.

Pay Attention to the Risks of Carbon Investing

While HNWIs increasingly consider the environmental, social and governance (ESG) factors when making investment decisions, you must be aware of the following risks when trading carbon futures ETFs.

The development of renewable energy technologies, the inclusion of new industries into the emission trading system, the supply of carbon emission allowances and the carbon reduction policies of the governments can significantly impact the value of carbon credits, causing volatility risk to carbon futures and the related ETFs.

Moreover, under the cap-and-trade principle, there is a cap on the total amount of carbon that companies covered in an emissions trading system can emit. The cap is expected to be gradually reduced over time so the governments can meet the emission reduction target. However, if cap reduction is slower than market expectations, it may cause frustration in the carbon trading market.