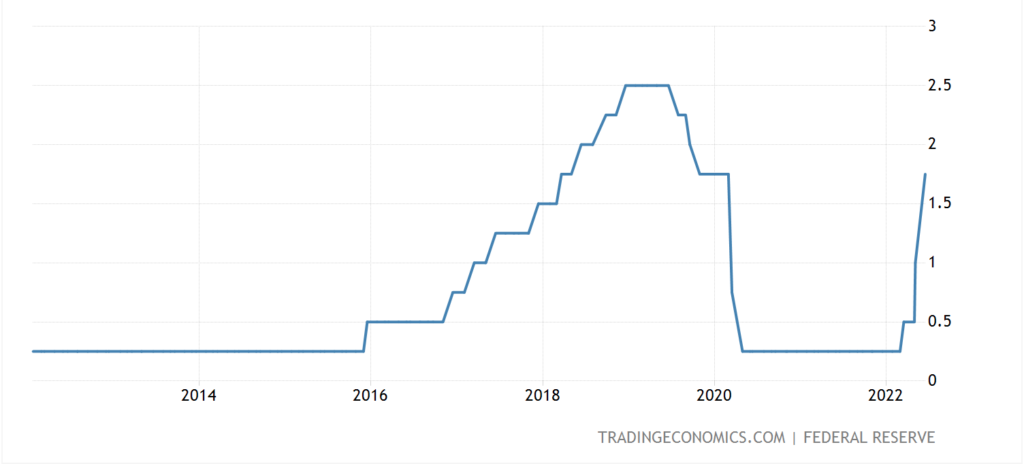

The U.S. Federal Reserve raised interest rates by 0.75% at its June meeting, the most significant increase in 28 years, lifting the target federal funds rate from 1.5% to 1.75%. Every time the Fed took action on the interest rate, the stock market’s institutional and retail investors worldwide reacted sensitively.

While combating the 40-year high inflation is a significant reason for the Fed to raise the interest rate, the consequences can be far-reaching. How do interest rates rise and fall affect the stock market and our finance?

The level of interest rates determines the macro economy of any country. When the interest rate increases, the cost of borrowing loans rises accordingly, leading to an unfavorable business and investment environment. From Warren Buffett to ordinary home buyers, consumers and individual investors, everyone suffers from higher spending on interest repayment.

Due to the risk avoidance sentiment, many individual investors prefer to keep their money in the bank or invest in U.S. government bonds to earn interest safely, which imposes additional pressure on the stock market amid the post-Covid era.

Over time, higher costs and the shrink of capital from investors could mean lower revenues and earnings for public firms, potentially impacting their growth rate and stock values. Investors’ fears of interest rate growth are reflected by the performance of the S&P 500 index, which dropped by more than 20% from its record high last year, confirming the arrival of a bear market.

Impact on the Asian Investment Markets

The United States is the world’s largest economy, and the dollar is an international currency dominating the global trading and investment markets. The Fed’s interest rate policy profoundly impacts the global economy.

Simply put, if a country or region does not follow the U.S. to raise interest rates, the interest rate differences inevitably lead to capital outflows and potential a sharp depreciation of its currency. While Thailand and Singapore are taking steps to tighten their monetary policy, not every Asian government follows the same way as the U.S.

In the current interest rate hike cycle, the central bank of Japan continued to take a dovish tone against the continuous growth of the US-Japan interest rate gap. As of 22 June, the Japanese yen’s exchange rate sank to 136.71 yen against the U.S. dollar, hitting a new low record since 1998. China is also easing its monetary policy to stimulate economic recovery from the pandemic.

On the other hand, Hong Kong follows the U.S. in raising interest rates as the city has implemented the linked exchange rate system since 1983. The interest rate of the Hong Kong dollar theoretically has to maintain the same pace as the U.S. interest rate to ensure monetary stability.

Low-risk Assets Become More Attractive

Raising interest rates is generally seen as a negative signal for the stock market. Investors can obtain better returns from low-risk assets from cash deposits and bonds, and there is less incentive to risk investing in the stock market. However, stocks in specific industries can still benefit from interest rate hikes.

For instance, investors can pay extra attention to bank and financial services stocks. Banks’ income predominantly comes from loan interest, and they can earn more in the interest rate hike cycle, and their stock prices may go up.

In addition, many companies listed on the Hong Kong stock market today are Chinese companies with income and profits coming from mainland China. Therefore, the rise and fall of the U.S. and Hong Kong dollar interest rates have minimal impact on the stock prices of these stocks, while the interest rate hikes or cuts of the Chinese RMB are even more remarkable factors.

However, high-net-worth individuals keen on leveraging their investment with loans should be mindful of the surge in borrowing costs. The same impact applies to property investors repaying their mortgage loans, bringing new uncertainties to Asian property investment markets.