Silicon Valley Bank’s (SVB) collapse, followed by the downfall of Signature Bank and the crisis of Credit Suisse in Europe, caused global ripple effects and significant drops in bank stocks worldwide. As Silicon Valley Bank customers are guaranteed to get their deposits back, and Credit Suisse has reportedly reached a deal to be acquired by UBS, the dawn of a solution to the crisis appears. However, the incident’s mid to long term impact on the global banking system and investment markets should not be underestimated. How should Asian investors respond to this ongoing and potentially new wave of crises?

Asian Companies Not Significantly Impacted by Silicon Valley Bank Incident, but Bank Stocks are Strongly Volatile

Some Asian tech companies have business dealings with Silicon Valley Bank (SVB), but most have emphasized that the incident has not affected their operations. There are at least 12 Hong Kong-listed companies, primarily in the biotech industry, with millions of dollars stored in SVB.

Japan’s Softbank Group, a major investor in the tech industry, may also have significant exposure to the incident. Additionally, China’s state-owned Shanghai Pudong Development Bank, which has a joint investment with SVB, downplayed the impact of the incident by suggesting that it has a regulated corporate governance framework and an independently operated balance sheet.

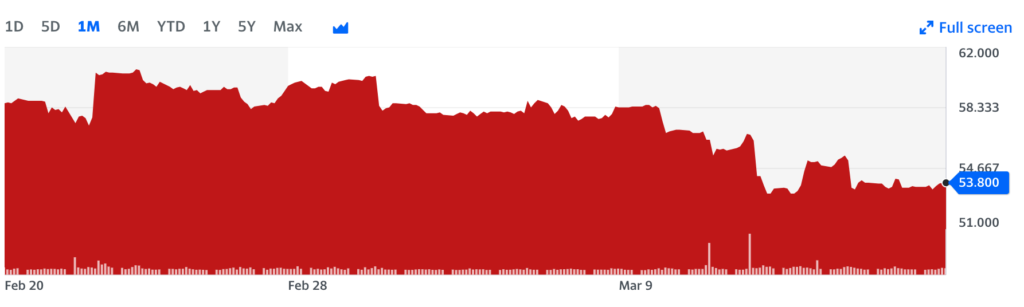

Many Asian bank stocks have recently experienced a significant downturn in the investment market, with some hitting their lowest point in over two months. For example, between 9th March and 17th March, the stock price of HSBC (0005.HK) fell by 8%, BOC Hong Kong (02388.HK) declined by 7.8%, and Sumitomo Mitsui Financial Group Inc (8316.TYO) experienced a drop of over 15%. However, most of these stocks have already recovered from their lowest points as the banking crisis in the United States shows signs of improvement.

Still, hedge funds and investors took advantage of the situation in North America and made profits while others were fearful. Citadel disclosed its 5.3% stake in Western Alliance Bancorp. Renowned investor Ron Baron also slightly increased his holdings in American securities firm Guggenheim Partners. For Asian investors who wish to buy at the market bottom, they may have missed the optimal timing. Also, market conditions may still change, so caution is advised. It is important to exercise prudence when making investment decisions.

Navigating Risk-Avoidance Assets in Times of Crisis

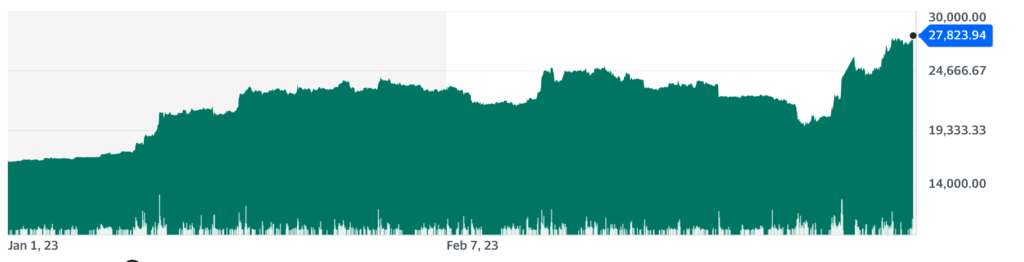

During times of crisis or uncertainty, investors often seek refuge in assets considered safe and low risk, such as the Japanese yen, gold, and cryptocurrencies like Bitcoin. The price of gold has even risen to levels approaching historical highs.

While the Japanese yen and gold are traditionally regarded as safe-haven assets, recent events have cast doubt on the hedging function of Bitcoin. The SVB crisis exposed the vulnerability of cryptocurrencies, and the stablecoin USBC briefly decoupled from the US dollar, falling to 0.87 before eventually recovering to a 1:1 exchange rate.

Despite BTC rising by 30% a week after the SVB crisis, the USDC crisis demonstrated that even stablecoins could experience significant price fluctuations and be exposed to systemic risks. Therefore, investors must cautiously approach cryptocurrency investments to diversify their risk in traditional financial markets.

Challenges to Investor Confidence the Foundation of the Banking System

The recent banking crises of SVB and Credit Suisse have raised concerns about the foundation of the global banking system. The need for the central bank and regulators’ assistance indicates that even large banks can be vulnerable to systemic risks, leading to declining investor confidence in traditional banks.

The SVB crisis has raised concerns among Asian start-ups about the safety and stability of the US financial system. Some start-ups may be looking to diversify their funding sources and explore alternative economic systems to mitigate potential risks.

On the other hand, amid the banking crisis, Credit Suisse initially rejected UBS’s acquisition proposal of US$1 billion. Swiss authorities once considered nationalizing all or part of Credit Suisse’s business. Later, With the intervention of the Swiss government and the central bank, UBS eventually agreed to acquire Credit Suisse for a price of US$3.25 billion.

Bob Michele, Chief Investment Officer of JP Morgan Asset Management, said that European, Swiss, and American regulators have responded to this crisis with unprecedented speed, reducing many cumbersome procedures and preventing the spread of a sell-off in European bank stocks. However, it is widely believed that the merger of the two Swiss banks will result in massive layoffs in Switzerland and the U.S.

In Hong Kong, Some investors have criticized HSBC’s recent decision to acquire the UK branch of Silicon Valley Bank for only £1, claiming that the board did not adequately safeguard the bank’s interests. The decision was made after only five hours of due diligence, and since the announcement of the acquisition, HSBC’s stock has fallen by 4.3% over four days. These investors believe HSBC’s board failed to protect the shareholders’ interests adequately.

Reassessing Interest Rate Hike Cycle

The successive collapses of Silicon Valley Bank and Signature Bank have continued to cause turbulence in the stock and bond markets. This has led to reassessing the path of US interest rate hikes. Goldman Sachs and Nomura believe that the Federal Reserve will pause its interest rate hikes this month due to the increased pressure on the US banking system caused by the Silicon Valley Bank crisis. Nomura has quickly revised its prediction from a 0.5 basis point interest rate hike to a 0.25 basis point rate cut and stopped quantitative tightening (QT).

However, there are also voices in the market that believe that the Federal Reserve will continue to raise interest rates due to the sustained high inflation in the US, as well as the need to maintain the credibility of its interest rate policy while addressing the liquidity needs of banks selling US bonds. If US interest rates shift due to this event, it will have significant implications for financial markets and loan rates. The potential shift in US interest rates due to these events could substantially impact Asian investors in terms of financial market performance and loan rates. Therefore, investors in the region need to stay informed of the latest market news and trend, and prepared for any potential impact on their investments.