China is home to the world’s largest property market, with a total value of USD 83.6 trillion in 2020. However, since last year, many Chinese real estate developers, such as China Evergrande Group, have fallen into debt crises. While the Chinese government and the banking sector lent a helping hand to gradually recover the real estate industry, another real estate company Sunac China, recently struggled with a debt default crisis in May 2021.

All property buyers and individual stock investors in China and the Asia Pacific are holding their breath to see whether China’s real estate market will gradually recover in the second half of 2022 as the local government expects.

How did the Debt Crisis of Property Developers Emerge?

In the past 20 years, China’s property market went through a golden development period, encouraging the real estate companies accustomed to high-leverage borrowing to seek higher profits. Some developers even began to get involved in other cash-burning businesses.

To take Sunac China as an example, when giant companies like Wanda Group and LeTV faced financial difficulties in recent years, Sunac incarnated as the “white knight” with its substantial financial power.

As the property market was booming, most developers made steady profits without losing money. Government and investors didn’t see their ever-expanding leverage as a threatening problem. Year after year, many real estate companies have taken on huge debts due to overexpansion.

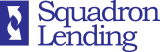

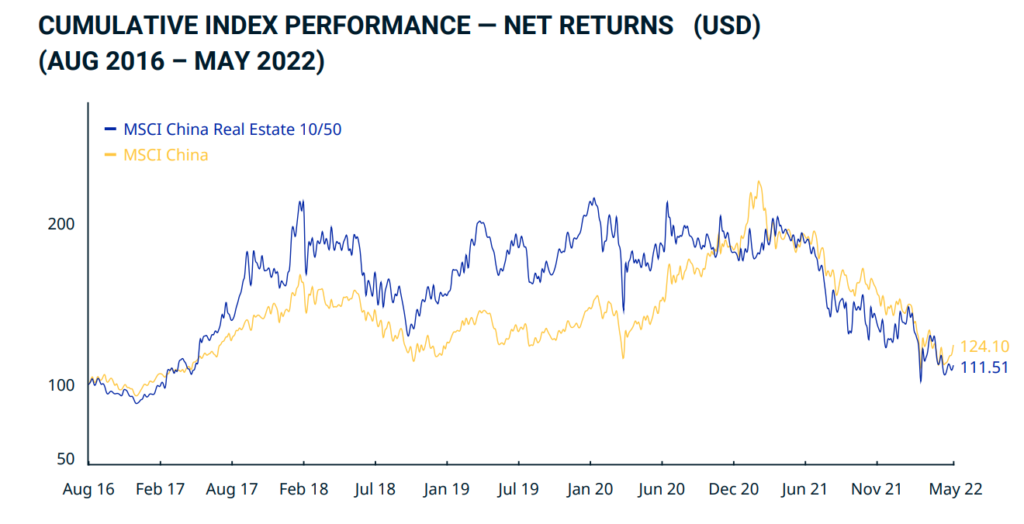

In August 2020, The Chinese authority implemented a deleveraging policy called “three red lines”, but the officials still overestimated the affordability of real estate development companies. As the policy was tightened, the national home price fell for the first time since 2015, and many companies fell into financial difficulties one after another. The MSCI China Real Estate 10/50 Index dropped by more than 30% in 2021.

Goldman Sachs analysts recently raised their forecast for the default rate of high-yield Chinese real estate bonds in 2022 to 31.6% from the previous 19%. Whether some of these companies can continue to survive in the future is now even a question.

Will the China Real Estate Market Rebound this Year?

On the other hand, China’s economy is facing downward pressure, mainly due to factors such as the Russia-Ukraine War, the U.S. Federal Reserve raising interest rates and the rebound of the Covid-19 epidemic.

The People’s Bank of China has repeatedly stated the importance of preventing the debt crisis of housing enterprises. The central government has increased investment in infrastructure projects and loosened real estate control measures. And local banks across the country approve home loans more easily than before. More than 100 cities in China have taken steps to boost the property market, such as lowering the mortgage interest rate and other rates and home down payments.

In Shanghai, Henan Province, a real estate company has launched a special offer allowing home buyers to “exchange houses with wheat” at 2 yuan/catty to offset the price of a property. Buyers can use wheat to settle up to RMB 160,000 of their down payment.

The China Real Estate Association and Zhejiang Real Estate Association announced they would jointly host a consultation meeting in Hangzhou in July to discuss introducing financial institutions’ rescue plans. There are also special sessions to negotiate company mergers, reorganisations, and cooperative development.

Evergrande, Sunac and other leading private real estate companies have suffered financial hardships, hitting investors’ confidence repeatedly. Under such an economic dilemma, many people in China’s investment community still believe that the financial difficulties of real estate developers can be temporarily relieved, and the market will be back to stable this year. One of their primary beliefs is that the real estate industry is a pillar of the Chinese economy and is “too big to fall”, and the government must save it at any cost.

To investors who foresee a rebound in China’s real estate, now could be an excellent time to buy an investment property or stock shares of developers. However, cautious investors should consider adopting a wait-and-see attitude and avoid entering this high-risk market. As the global stock market is in a bear market, there are a lot of cheap shares across different sectors, and investors should think twice before adopting a bargain-hunting strategy.