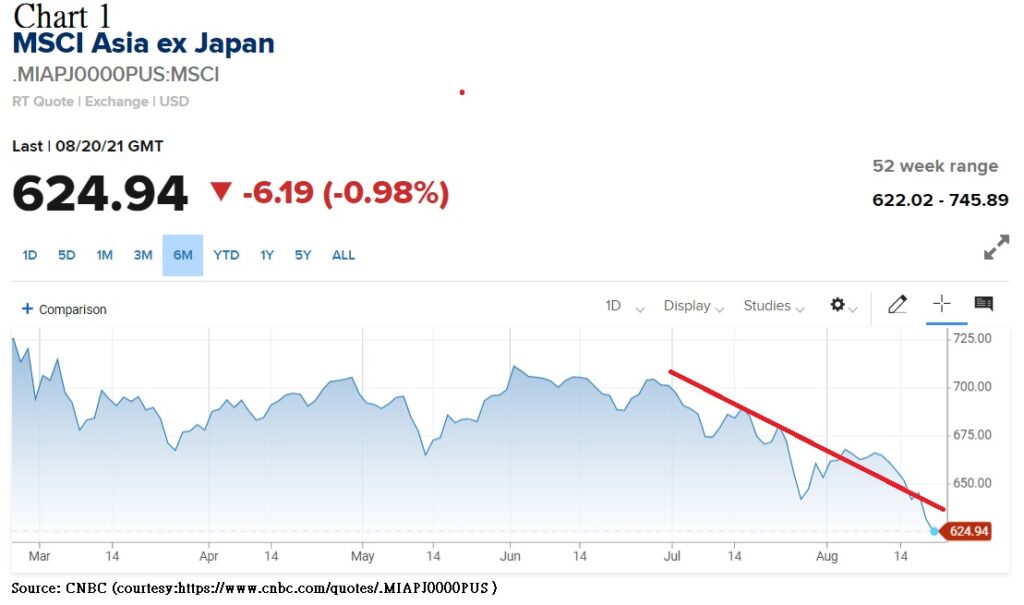

The worry over the progress of economic recovery in Asia being hindered by widespread Covid 19 & Delta variants across the region is at par with current market panic triggered by China’s tightening regulatory coverage over a broad array of sectors. According to MSCI index which tracks Asian equities excluding Japan’s, Asian equities are lacking up-climbing momentum as seen in (Chart 1)

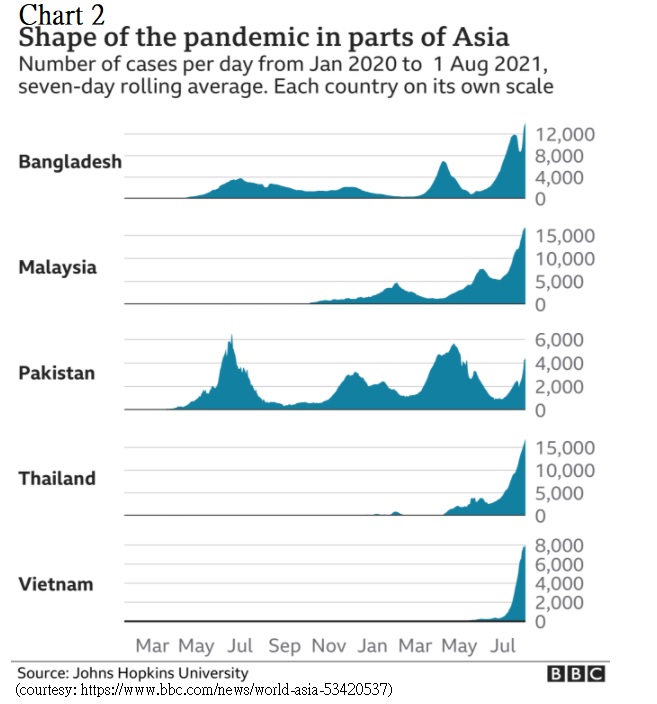

throughout July to recent August. Japan’s Nikkei index also sees recent up-climbing fatigue as observed in other Asian equities markets, but the position has already been 3-years peak. As commented by Carlos Casanova from UBP, Asian market volatility is made up by China’s regulatory drive and the severity of Covid 19 outbreaks in Asia. Severity of Covid 19 outbreaks throughout the region represented by five severely afflicted countries sees climbing to a half-year peak since July according to Johns Hopkins University (Chart 2).

throughout July to recent August. Japan’s Nikkei index also sees recent up-climbing fatigue as observed in other Asian equities markets, but the position has already been 3-years peak. As commented by Carlos Casanova from UBP, Asian market volatility is made up by China’s regulatory drive and the severity of Covid 19 outbreaks in Asia. Severity of Covid 19 outbreaks throughout the region represented by five severely afflicted countries sees climbing to a half-year peak since July according to Johns Hopkins University (Chart 2).

Low vaccination rates and doubt on effectiveness of vaccination

The Asian economic recovery is fatigued, leading to a losing direction throughout the regional equities markets. There sees a non-sustainable upsurge in the long run throughout the region despite a steadily improving trend of certain Asian countries during the pandemic. Relatively low vaccination rates across the region and poor effectiveness against further outbreak even after double-jabbing cause the markets to lack the sustainable growth momentum. Chart 3 shows the latest vaccination statistics by country, from which below 10% full vaccination rates of severely afflicted Asian countries are significantly lower than the status of some Western countries which achieve 50 – 70% full vaccination. Uncertainty arisen from low Asian vaccination rates and perceived poor effectiveness of vaccination against Covid 19 pandemic would continue affecting the route to regional liberalization of all Covid 19 restrictions which hinder full-scale economic recovery and growth of the Asian stock markets.

Variation of market reaction to Covid 19 and variants amongst Asian countries

Although the Covid 19 outbreak does affect economic recovery and investor confidence, Asian bourses do show different degree of reaction to the coronavirus spread. China equities are relatively immune from the global coronavirus-induced market panic. Strong official control of coronavirus spread by Beijing over recent national outbreak does not result in the upsurge of Chinese stock markets. Covid 19-related factors to China’s markets compared with other Asian bourses show relatively lower correlation with stock market performance. Recent market downfall in China is wholly triggered by Beijing’s regulatory rectifications. The hike of Covid 19 cases in China plays a less important role in shaping the performance of China’s equities market, probably thanks to market confidence of coronavirus containment by China as evidenced by her remarkable anti-coronavirus resume. Before July’s regulatory storm, Chinese stock markets even saw price peaks. Shanghai Composite Index has climbed up to 3-years peak at 3,696.17 in this year February whereas H.K.’s Hang Seng Index was at 30,644.73 at the same period.

Other Asian bourses especially under severely afflicted countries address relatively higher correlation of coronavirus with market performance. Hardest hit economies with infections, say Thailand rely much on tourism and external macro-environment. Her SET index does not see 3-years price peak at the same period as China’s market. Instead, it has experienced fatigue to grow despite her market digestion of coronavirus spread news. Compared with China’s, Thailand economic fundamentals get much more worsened as seen by weaker domestic consumption and nation-wise disruption in manufacturing production. Uncertainties arisen from such worsening fundamentals have pushed Thai stock market to attempt historical price troughs and higher volatility.

The stock markets of Japan and Korea could have performed better because of their sectoral composition across the country is significantly different from those of Thailand and other South Asian severely afflicted countries. However, coronavirus transmission would still be a hinderance factor in their stock markets. Japan’s Nikkei index has already seen 3-years peak at 30,017.92 in this year February. South Korea’s KOSPI Composite Index has arrived at a recent peak of 3,270.36 in this year August. Both markets tumbled during the first tide of Covid 19 across Asia in early 2020 but bounced back impressively a few months afterwards. Amongst Asian bourses, Japan and Korea are two most impressive out-performers amidst a coronavirus-panicked atmosphere. It is not certain whether there are adequate bettering fundamentals fueling their growth momentum during the pandemic of Delta and possibly other variants.

All in all, coronavirus spread does affect the Asian economy which is one of the fundamental factors to shaping the regional stock market. Variation of market performance in response to coronavirus in different bourses reflect investors’ forecasts of how sectors and industries in different economies will fare. Investor confidence in certain Asian stock markets say Japan and Korea reflects relative strength of these countries’ business sectors in recovery and generation of shareholders’ value despite uncertainties pertinent to the pandemic and emergence of coronavirus variants.